JHU is committed to helping its faculty and staff achieve financial well-being and offers many resources for advice as well as savings.

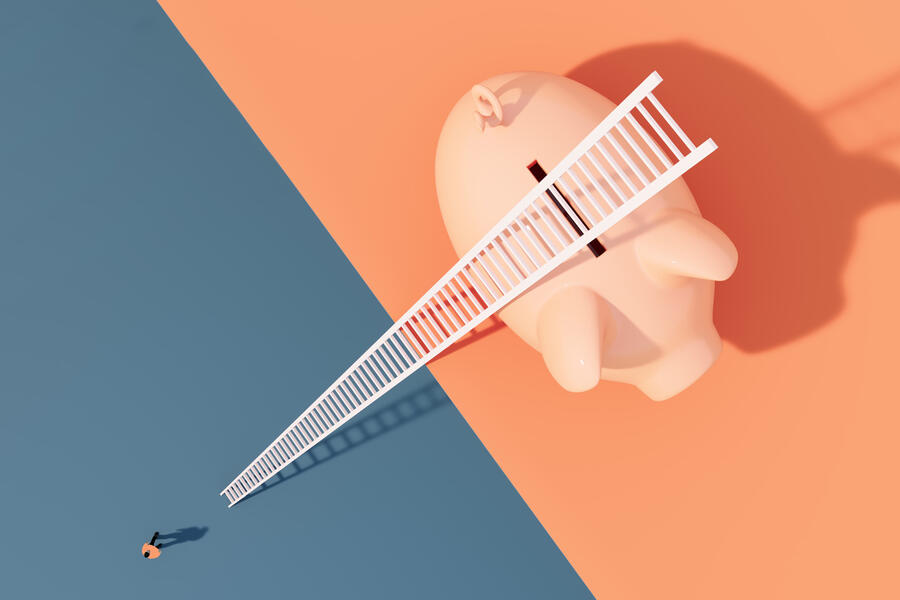

Effective early 2025, the JHU retirement program will be updated to help employees automatically save for retirement. New hires and faculty and staff who are full time and eligible but not currently enrolled will be automatically enrolled in a JHU 403(b) plan at a 3% pretax savings rate and will be able to gradually increase how much they save on a schedule of their choice. You always have the choice to opt out, but before you do, take a look at the benefits of the 403(b) plans.

Why contribute to a 403(b)?

A 403(b) is designed to provide long-term financial security. Retirement industry research indicates that many Americans are not saving enough for retirement. By contributing to your 403(b), you are taking an important step toward feeling confident that you will have enough money to live comfortably through your retirement years.

In addition, JHU adds to your savings by making contributions to your 403(b) after you turn 35 or, if younger than 35, when you have completed two years of service. You are always 100% vested in all contributions, including those from the university, meaning you own the funds in the account. Read more about the plans here.

The auto enroll and auto save features of the 403(b) plans will improve retirement preparedness, increase your account balance, reduce your decision-making burden, and provide peace of mind that you are preparing for retirement.

Maximize tax savings with the Roth option

Through the Roth option, you can make contributions that are taxed based on your current tax rates, so you can make tax-free withdrawals later in retirement after meeting certain criteria. This option may benefit you if you expect your tax rate to be the same or higher in retirement. Your combined pretax and Roth after-tax contributions are subject to the same annual IRS-established maximum limit.

Visit the Retirement Plans Enrollment page for more information, or log into your 403(b) account with TIAA. If you have questions, call TIAA at 888-200-4074, 8 a.m. to 10 p.m. weekdays, or 9 a.m. to 6 p.m. Saturdays.

MMA Prosper Wise—your trusted adviser

Planning for your financial future mustn't be complicated, nor must it rest on you alone.

JHU partners with the Marsh McLennan Agency to offer free retirement plan advice and education to employees. MMA Prosper Wise is a digital hub of financial planning resources to help you make decisions about your finances and retirement investments. You can schedule a consultation with a financial coach to assist you with your retirement plan investment questions. The coaches are MMA employees and licensed professionals with areas of expertise in retirement plans, investing, and financial education. They are unbiased and do not sell products or receive commissions.

Posted in Benefits+Perks

Tagged hr newswire