JHU offers a growing list of spending accounts designed to help you stretch your paycheck and benefit from tax savings.

Effective Jan. 1, 2020, Discovery Benefits will replace WageWorks as the administrator for the health care and dependent care flexible spending accounts (FSAs), and for commuter benefits.

Discovery Benefits will also administer the university's new health savings account and limited purpose FSA.

With Discovery Benefits, you'll have access to enhanced resources, tools, and payment options to make it easier to manage your accounts. The addition of the high-deductible health plan (HDHP) also adds some new spending account options that work specifically with this type of medical plan.

The HDHP's sidekick: the health savings account (HSA)

While the HDHP works much like a traditional medical plan, the ability to participate in a health savings account makes it unique. If you choose the HDHP, you are eligible to participate in a special tax-advantaged HSA that allows you to set aside funds on a before-tax basis to help fund your out-of-pocket costs. If you earn $60,000 or less a year, JHU will add to your HSA. The amount of the annual contribution will depend on your pay band, as follows:

- <$40K band: $500 single/$1,000 family

- $40K–$60K band: $250 single/$500 family

Unlike the funds in flexible spending accounts, your HSA funds roll over from year to year, so you can spend them now or save them for later.

Pairing your HSA with the FSA

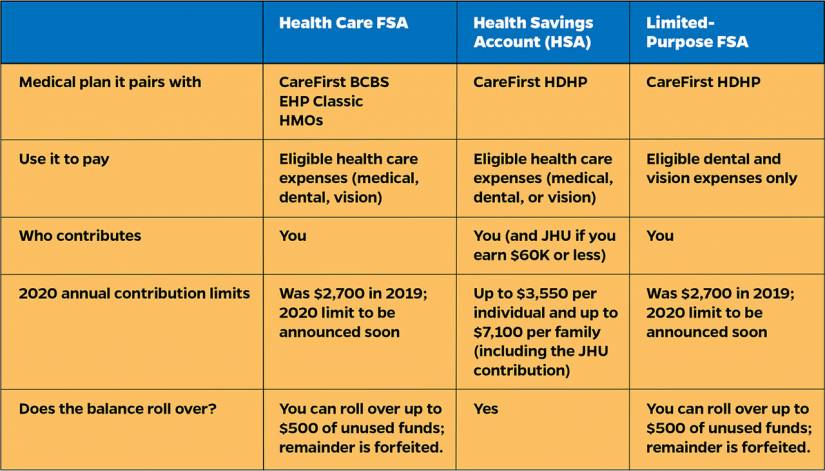

It's important to note that you cannot participate in both the HSA and a general purpose health care FSA. However, Johns Hopkins is introducing a new limited purpose FSA for HDHP participants that can be used for eligible dental and vision expenses only. The maximum contribution limit is the same as under the general purpose health care FSA (limit for 2020 to be announced soon). Consider participating in both the HSA and limited purpose FSA to maximize your savings and tax benefits.

Comparing your spending accounts

Important reminders

If you enroll in the FSAs or HSA for 2020, you will receive a welcome package from Discovery Benefits including a new Discovery Benefits debit card and important information about how to manage your accounts.

If you are participating in the FSAs for 2019, you can roll over up to $500 of your remaining health care FSA balance to your 2020 health care or limited purpose FSA with Discovery Benefits. Any remaining dependent care FSA funds will be forfeited.

Filing FSA claims. Keep in mind that any FSA claims incurred during 2019 must be submitted to WageWorks by April 30, 2020. Claims for expenses incurred as of Jan. 1, 2020, will be processed through Discovery Benefits.

Commuter benefits. For 2020, you will make your monthly elections in the JHU Benefits & Worklife myChoices enrollment site at hr.jhu.edu/benefits-worklife. Transportation passes will be purchased online at discoverybenefits.com.

Tools for managing your spending accounts

Discovery Benefits will provide enhanced resources, tools, and payment options for added convenience. Visit discoverybenefits.com to access a number of tools and resources to help you manage your FSAs, HSA, and commuter benefits, including:

- Information about using your Discovery Benefits debit card and the mobile app

- Tools to track claims and process payments online

- Education and tools to help you make the most of your accounts

Posted in Benefits+Perks

Tagged hr newswire