When approached by a startup seeking funding, angel investor Catherine Chiu, Engr '78, asks herself, Do I want to be in a relationship with this company for the next nine years?—the average time it takes a startup to exit to market.

In June, six entrepreneurs faced Chiu and other panelists at Startup Demo Day, hosted by the Johns Hopkins Alumni Association's Entrepreneurship affinity group. The event gathered 75 members of the Johns Hopkins community in the Bay Area to see the startups pitch their ventures to investors, advisers, and seasoned entrepreneurs.

All six startups got funding. How?

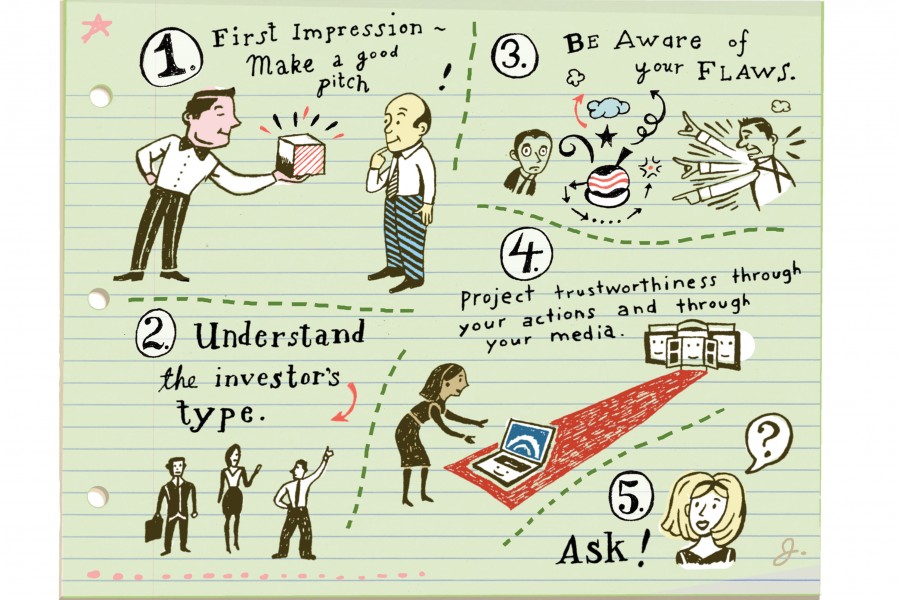

If the answers read more like a checklist for landing a soul mate than an angel investor, that's the point. Building a startup is all about developing relationships, say event panelists Chiu and David Gutelius, A&S '98 (MA), '01 (PhD).

1. Remember that your pitch is just your first impression in a relationship that will be a lot like a marriage, Chiu says. You'll have to work to prove your worth. "Entrepreneurs should always keep in mind their value proposition to the investor," says the finance specialist.

2. Rather than polishing your pitch, build your business. If you build it, investors will come. When they do, understand whom you're talking to, Chiu says, because investors have types, too. And be choosy, says Gutelius, a serial entrepreneur, because the wrong investor can signal to other investors that you're not careful about your relationships—or your business.

3. "Being a business founder is mostly about being wrong and learning fast," Gutelius says. Learning from your mistakes improves relationships. Even the brightest startup teams, adds Chiu, have weaknesses. She can live with that.

4. What no investor can live without: the trust between investor and entrepreneur that holds the whole deal together. Trustworthiness is projected by how you act in the world, Gutelius says, whom you are linked to, and what values you project.

5. Entrepreneurs stress over timing. Will they be too early to market or too late? Control the elements you can control, Gutelius says. Continually test by getting your product into people's hands. Eventually, though, you just have to make the leap.

For more info: alumni.jhu.edu/affinitygroups

Posted in Science+Technology, Voices+Opinion