Kathryn Edin has been an itinerant scholar of the poor for more than 20 years. She is a sociologist who works like an anthropologist, melding numbers and narrative to examine in illuminating detail the lives of poor people all over the United States. She has worked in Austin, Texas; Baltimore; Boston; Charleston, South Carolina; Camden, New Jersey; Chicago; Cleveland; Dallas; Milwaukee; New York; Philadelphia; and San Antonio; as well as Appalachian Tennessee and the Mississippi Delta. Her book titles signal where she has focused her effort: Making Ends Meet: How Single Mothers Survive Welfare and Low-Wage Work; Doing the Best I Can: Fatherhood in the Inner City; and Promises I Can Keep: Why Poor Women Put Motherhood Before Marriage.

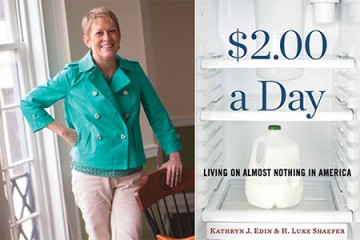

Image caption:

Image credit: Matt Roth

In the summer of 2010, Edin was in the seventh year of a long-term study of children born in public housing in the early 1990s. At Latrobe Homes, a 700-unit housing project in East Baltimore, she encountered the 19-year-old woman she calls Ashley. "She had a two-week-old baby," Edin recalls. "When we walked into the house, the first thing I noticed was that as she was rocking her baby, she wasn't adequately supporting the head, and as a mother you know something's wrong. She just looked depressed, no expression on her face. She was visibly unkempt." Edin was sitting on the kitchen floor while she interviewed Ashley—there was only one chair—and she could look up and see there was no food in any of the cabinets. Despite six people living in the unit—Ashley, her baby, her mother, her brother, an elderly uncle, and a young cousin—there was almost no furniture. Edin noted a table with three legs that wouldn't stay upright unless propped against a wall, a filthy mattress with a Bugs Bunny fitted sheet, and a couch. The elderly uncle was on the couch nodding over in a heroin daze. Edin had witnessed plenty of poverty in her career, but not this bad. She knew from Ashley that no one in the household had a job, nor was anyone receiving public cash assistance. This was a family with no income. Edin recalls: "My first thought was that we'd found a whole new kind of poverty that we didn't think existed, and I wondered what was going on."

Since 2014, Edin has been a Bloomberg Distinguished Professor in the Krieger and Bloomberg schools, and recently she became director of the 21st Century Cities Initiative, one of the signature initiatives of the Johns Hopkins Rising to the Challenge capital campaign. But when she came across Ashley, Edin was on the faculty of Harvard's Kennedy School of Government. A young visiting professor named Luke Shaefer had recently arrived at Harvard, and he was expert at mining a government data set that social scientists refer to as "the SIPP," the Survey of Income and Program Participation compiled by the United States Census Bureau. The SIPP captured more of the income of the poor than any other representative survey. "I told him about Ashley," she says, "and I said, 'Let's work out something together. Let's figure out if this is a thing.'"

It was a thing. The SIPP polls about 40,000 households all over the United States regarding any source of cash income they have had in the previous four months, including government assistance. The data indicated to Shaefer and Edin that in any given month, 1.5 million families, including 3 million children, were surviving on cash incomes of no more than $2 per person per day. More than a third of these families were headed by a married couple. Nearly half were poor whites. Shaefer says, "I can picture in my head that very first readout of the data. I was sitting in the main Harvard library reading room. I hadn't really known what to make of what Kathy said she was seeing, and then out pops this output. I was just wowed by it. I said a couple of words I'm pretty sure cannot appear in your magazine."

For comparison, the official U.S. government poverty line for a family of three in 2015 is $20,090 in income per year; that works out to a bit more than $18 a day per person. About half of the 1.5 million families in Shaefer's data were receiving food assistance by way of the Supplemental Nutrition Assistance Program, or SNAP, the equivalent of what used to be called food stamps. Many had lived for a time in shelters or various precarious arrangements with kin, friends, or acquaintances, and had found other forms of help including public health insurance for their children. So they were not solely dependent on $2 a day for survival. But the United States has a cash economy. You cannot buy shoes for your children or pay the electric bill or take a bus to a job interview without money. How on earth were more than 4 million people living on no income? "In Ghana, where 80 percent of the economy is barter and noncash, it's one thing to live on $2 in cash per person per day," Edin says. "What does it mean to live cashless in the world's most advanced capitalist country?"

Shaefer and Edin were so startled by the numbers that they first tried to refute them. "One thing I don't think outsiders recognize about scientists is how hard we work to prove ourselves wrong," Edin says. They dug into other data sets, like public school reports on the number of homeless children in classrooms and the annual rolls of government food assistance, which record how many families report no cash income. They were looking for results at odds with what Shaefer had found in the SIPP. But everywhere they looked they found only corroboration. "The Census Bureau didn't believe us and chose to rerun our numbers," Edin says. "They got the exact same results."

So Edin and Shaefer crunched economic data to find 18 statistically representative families who had recently experienced at least three months of cashless poverty. Then, in 2012, Edin and a team of research assistants began documenting the daily lives of those families, to understand how they survived on so little and what their lives were like. The results were published in $2.00 a Day: Living on Almost Nothing in America (Houghton Mifflin Harcourt, 2015). The volume includes enough history of welfare in the United States to explain how the country got to this point, plus some policy suggestions for going forward. But the heart of the book is the narrative material that vividly conveys what it means to find yourself so disconnected from the economic system.

Politicians and commentators who favor restricting welfare benefits often portray poor people as a segment of the population that has fallen into poverty through a lack of initiative or personal responsibility, or who prefer public handouts to working for a living. To the contrary, the people Edin studied embody what Americans like to think are the cardinal virtues of upstanding citizens. They are resourceful, inventive, thrifty, and not just willing to work but eager to work. They seize every opportunity for employment and want nothing as badly as they want stable, full-time jobs. But they have fallen out of the 21st-century U.S. economy at a time when there is little in the way of a net to catch them, and they face overwhelming obstacles to clawing their way back up. And there aren't a handful of them. There are millions.

For $2.00 a Day, Edin studied families in four locales that Shaefer's quantitative research told her would be representative of the larger picture. For a typical, prosperous major American city, she picked Chicago. For a once booming city now enduring a long downturn, she selected Cleveland. Analysis of the SIPP data turned up clusters of extreme poverty in Appalachia and the Deep South, which sent her team to families in Johnson City, Tennessee, which had experienced something of a resurgence, and the rural Mississippi Delta, which had been impoverished for decades. "Our initial analysis raised more questions than answers," she says. "Who are these people? How did they get into this situation? What were they actually doing to survive? Obviously, they couldn't really be living on just $2 a day."

Edin found that life in this kind of deprivation is complex, unstable, physically and psychologically punishing, and contingent upon small day-to-day events that could put someone out of work, out of shelter, and out of luck in the space of a week. Start with finding work. To interview for a job requires a clean, decent set of clothes and the opportunity to bathe; both can be problematic for anyone living in a shelter or in a relative's apartment with six other people. Unless the job seeker has the luck to be close enough to walk to the interview, he'll need access to a car or money for the bus. Few businesses hire anyone on the spot, so the applicant will also need a $30 refurbished, pay-as-you-go cellphone for callbacks. (Sociologists often note that it's expensive to be poor.)

If the person does get a job, it will probably be in the service sector for minimum or sub-minimum wage. Many employers, like big-box stores, chain restaurants, and coffee shops, have adopted computerized systems that allow them to adjust their workforces day by day in response to changes in customer flow, the effects of sales events, seasonal fluctuations in business, even changes in the weather. So anyone holding down an entry-level job with one of these businesses is unlikely to have a dependable, steady, 40-hour-a-week work schedule that allows him to plan for all the other quotidian stuff that demands time and attention. He may be called in for 12-hour shifts over three straight days, or a couple of 16-hour open-to-close shifts at a coffee shop, then work only 10 hours all the next week. He may find his hours zeroed out, which means he is still technically employed but will have no income for that week. If he can't be flexible enough to accommodate the employer, he will lose the job because there is no shortage of people desperate for work who will take his place. If a parent needs time off because her child is sick or she needs to meet with the child's teacher or the car has broken down, forget it. In these jobs no one gets sick days or personal days or vacation.

The instability of work will be matched by instability in every other aspect of life for the poor. They may qualify for subsidized housing but are unlikely to get it since the wait list in many places is tens of thousands of people long and frequently closed. They may have enough money for a ramshackle apartment, but that will require regular income for rent, as well as for the electric and water bills. Losing a job or even a week's worth of hours can mean losing the apartment and having to resort to a shelter or a room in someone's house, and the people who take them in might well live in precarious situations of their own, not to mention three bus lines and two hours from that precious job. Children might have to spend six months in a house with relatives or strangers who have drug problems or are physically abusive. To be this poor means being vulnerable to every sort of predator.

In $2.00 a Day, the reader meets several people who live like this. Jennifer Hernandez (to respect their privacy rights and abide by institutional review board rules for the research, Edin created pseudonyms for everyone in the book) and her two children moved from one homeless shelter to another in Chicago. In the two and a half months spent at the third of those shelters, she applied for more than 100 jobs before landing one with a custodial company that cleaned foreclosed houses, many of which had been broken into and trashed by squatters and junkies. Working in filthy, unheated rooms during a Chicago winter, she kept coming down with respiratory problems and viral infections that she took home to her children, which led to missed work when they were home sick, which resulted in her hours being cut back so much she had to look for another job. But even at the worst times, she would not register for welfare benefits. Welfare was a handout and she would have none of that.

Modonna Harris, also in Chicago, had a high school diploma, two years of college, and a child from a broken marriage. For eight years, she held a full-time, $9-an-hour job at a music store but was summarily fired one day when her cash drawer came up $10 short. She then fell behind in her rent, was evicted, and had to move in with a succession of relatives who would shelter her and her daughter, Brianna, for only a few months at a time before turning them back out. Brianna still managed to make her school's honor roll one term. When food was in short supply, Modonna would turn a cup of coffee into "breakfast" by dumping in as much cream and sugar as the mug would hold.

There was Rae McCormick in Cleveland, whose mother abandoned her soon after her father died. At age 12, she lived for a time on her own, sheltered by a sympathetic landlord who let her stay in an apartment rent-free. By 21 she had a daughter to support and the deteriorating health of a much older person. Nevertheless, she managed to secure a full-time job with Walmart and in her first six months was named "cashier of the month" twice and encouraged to apply for promotion. Then one day she could not drive to work because the family friend whose truck she borrowed had run it out of gas and she had no cash to buy more. Her boss told her not to bother coming in anymore. Soon she spiraled down to $2-a-day poverty.

There's Paul in Cleveland who lost his house and savings when his chain of pizza parlors went bust. Martha in Mississippi who sold Kool-Aid pops and, on special occasions, a homemade delicacy, Kool-Aid Pickles, out of her living room for 50 cents apiece. Jessica Compton, a skinny, worried 21-year-old in Johnson City who sold her plasma twice a week because she had two kids and Red Lobster and McDonald's had zeroed out her and her husband's work hours when the seasonal economy slowed. They were three months behind in their rent and expected to be evicted any day, and she lived in terror that her iron levels would be too low for her to donate and receive the desperately needed $30 she collected for each plasma donation.

When the people Edin studied saw no other way, they sometimes broke the law to obtain cash. A woman might have "a friend" who would pay the electric bill one month in exchange for sex. The food assistance program, SNAP, is an in-kind benefit, a debit card that can be used only to purchase food. So the extremely poor sometimes traded $100 of SNAP groceries to a neighbor or family member for $60 in cash. This was risky; under federal sentencing guidelines, penalties for food stamp fraud are more severe than for voluntary manslaughter, aggravated assault with a firearm, or sexual contact with a child under 12. One woman studied by Edin in the Mississippi Delta sold her three children's Social Security numbers for $500 each to family members, who then claimed the children as dependents so they could collect tax refunds.

The researchers were meticulous about documenting their subjects' lives and corroborating what they reported. Nearly every interview was transcribed (they had to rely on fact-checked field notes once when the recorder malfunctioned) and every transcript coded. Whenever they could, the researchers found multiple sources to confirm what their subjects reported about their communities and work environments and schools. "We have a saying, 'Hearsay is not evidence,'" Edin says. "We get as close to the source as we can. You can never be sure—someone can always be lying to you. But for every claim that was made in this study, there were multiple verifications. The best fact-checking we do is staying with people for a long time."

Edin's exposure to poor people came early. She grew up in northern Minnesota on the boundary of two economically depressed counties. Her father ran the local technical college, so her family was middle class, but the poor were all around her and a routine part of her childhood. Her mother held a degree in parish work and did church-based social work on behalf of the small Evangelical Covenant church the family belonged to, driving all over in a van with Edin in the back. "She was the youth leader, and man, there was no youth that didn't get a knock on the door," Edin says. "I spent a lot of time hanging out with kids at the very bottom of the income distribution. I thought it was fascinating, and I thought it was normal to have your mother running around the county treating everyone like they mattered."

After earning an undergraduate degree at tiny North Park College (now North Park University) in Chicago, Edin enrolled at Northwestern University for graduate study in sociology. "You went to Northwestern to do one of two things. You either went to study with the great quantitative mastermind Christopher Jencks, or you went and studied with the qualitative guru Howard Becker." She cultivated both as mentors and absorbed their different methodologies. "Howie's approach was to go out to a place where you could find a lot of the people you were studying and just hang out with them. Jencks was concerned with things like sampling and gathering numbers. Howie would have me out at laundromats meeting welfare moms. But Jencks got me to systematically sample across Chicago so that I had no more than three respondents from any given social network and could claim some level of representativeness."

While she was at Northwestern, she taught in a church basement as part of a North Park program that brought college courses to poor people. "After class, we would just sit around and talk," she says. "I would relay things that I was learning in Jencks' poverty class and then these women would say, 'Oh, girl, that's not how it works at all. This is how it really works.' So one day we started talking about welfare, and they said, 'Girl, don't you know that everybody has to cheat to survive? Welfare doesn't pay enough.'" This was the seed for Edin's first book, Making Ends Meet, written with anthropologist Laura Lein. "We showed, after six years in four cities and multiple interviews with 400 low-income single mothers, that you couldn't live on welfare alone anywhere in the country. You actually had to work under the table to survive." Most people without work did not have sufficient welfare benefits to get by, but when they had work and reported the income, they lost benefits. Either way they came up short. The only solution was to earn money by whatever means but not tell the government about it.

Edin developed what became her signature approach to sociology: rigorous data mining to determine subjects for her to study in the manner of an anthropologist doing field work. For one project, she and colleague Paula England followed 75 couples for four years, amassing 75,000 pages of transcripts. The research for Making Ends Meet began with a study of census data to select cities that represented the range of labor markets and welfare systems around the country. Edin then spent six years interviewing welfare mothers and reporting the narratives that recorded the texture of their lives. The study's firm foundation in data was exemplified by the back of the book, which included 27 regression analyses, a technique for examining statistical variables and their relationships. The quantitative work applied social science rigor to the research so that it produced something more than a collection of vivid narratives, something scientifically meaningful that could also drive social policy. The narratives revealed the lives within the data. Her Johns Hopkins colleague, sociologist Andrew Cherlin, observes, "Kathy thinks like a sociologist and talks like an anthropologist."

One chapter of $2.00 a Day explicates the changes in welfare that did benefit many people but sent millions more spiraling into extreme poverty. In 1996, Congress passed and Bill Clinton signed the Personal Responsibility and Work Opportunity Reconciliation Act, which was promoted as sweeping welfare reform aimed at getting people off cash assistance and into jobs. It replaced open-ended cash assistance with a severely time-limited cash program and the requirement that all able-bodied recipients had to work. Those fortunate enough to have work qualified for the Earned Income Tax Credit. The EITC was cash assistance but in the form of an annual tax credit for people employed in low-income jobs. The more money they earned, up to a point, the bigger the credit, and the annual supplement could be upward of $5,000, a major boost to poor families. But if you didn't have a job, you didn't qualify. So under the new law, people who arguably needed cash the most—the unemployed, who had to pay for shelter and utilities and clothes and transportation and other necessities but had zero income—no longer qualified to receive any cash once they had run out their brief eligibility.

The legislation was popular with voters because it encouraged work and all but did away with what they regarded as handouts. Opinion polls consistently indicate that the majority of Americans approve of helping the poor, but not if that help comes in the form of a welfare check. Peter Edelman is a law professor at Georgetown University and faculty director of the Center on Poverty and Inequality there; he resigned from the Clinton administration in protest when the president signed the 1996 law. He says, "If you ask the public, 'Do you favor education for low-income children?' they say yes. 'Do you think there ought to be help for low-income people for better health?' Yes. 'Help with hunger?' Yes. 'Housing?' Yes. But when you suggest just giving the poor money, the public has a different attitude. They regard that as giving something for nothing." Says Edin, "In America, work is about citizenship. You can't be a citizen if you're not a worker."

The reform worked for some people. In 1993, only 58 percent of low-income mothers were employed; by 2000, that figure had risen to nearly 75 percent. Child poverty rates fell four straight years after passage of the law. The EITC tax credits meant a great deal to those able to find and keep jobs. "The more you worked, the more you got, and that made them feel a great deal of pride," Edin says, "whereas welfare had the opposite effect, making them feel shamed and stigmatized. This citizenship-enhancing feature of the EITC is like policy magic. This is probably the best policy we've ever invented for poor people. Except it leaves out our people"—the people in $2.00 a Day—"because they don't have enough work to claim anything. They are working when they can, but they're at the ragged edge of the labor market. It's like hanging on to a rope that's dissolving in your hands."

The 1996 law, Edin points out, was based on the assumption that hundreds of thousands of people dropped from the old welfare rolls could find stable, full-time employment that paid living wages. And when the legislation was enacted, the economy was booming. What was not well-enough understood was that too many of the jobs provided by the labor market, especially for the uneducated and unskilled, were low-wage and unstable, and there were not enough of them to meet demand. The recession that began in 2008 further reduced the number of available jobs. In her book, Edin describes this as the "toxic alchemy" that pushed so many people into the deepest poverty. By the mid-2000s, one in five single mothers had become what sociologists call "disconnected"—neither working nor receiving welfare. During her research, Edin was struck by how many people had not even bothered to apply for benefits they were qualified to receive. They assumed, or had been told, that the system offered them nothing and they were on their own. And some simply refused to seek public assistance. "The key thing about these people is they see themselves as workers, not dependents," Edin stresses. "We know from the SIPP that only 10 percent of these families get a dime from cash benefits."

All the people she studied during the course of her research repeatedly sought work and took it whenever they could. Recall Ashley, the 19-year-old Baltimorean with the 2-week-old baby who first got Edin wondering about the poorest of the poor. As part of the protocol for the study that had brought her and Edin together, Edin paid Ashley $50 for the interview. The next day, Edin found pretext to go back and see her again because she was so worried by what she'd seen of how Ashley was interacting with her baby. When the young woman answered the door this time, Edin says she was transformed. She had placed the baby with her mother for the day, had used some of the $50 to get her hair permed and buy a pants suit at Goodwill to make herself presentable for job interviews, and was on her way out the door to look for work. Edin remembers her as utterly changed by the mere possibility of finding a job.

With Cherlin and fellow Johns Hopkins sociologist Stephanie De Luca, economist Robert Moffitt, and researchers from the schools of Medicine and Public Health, Edin has embarked on a yearlong project to plan a major multidisciplinary study of the extreme poor, a project that will be the first of its kind. She has kept in touch with most of the 18 families she studied for $2.00 a Day. "None of our families are doing appreciably better than when we first met them," she says. "Our hypothesis, that remains to be tested, is that once you find yourself in one of these spells, the work of survival becomes so all-consuming, and the wear of physically living in this condition becomes so acute, you can't really get out of it."

There seems to be little public support for a retooling of the welfare system sufficient to help the extreme poor. Part of the problem may be that to most of the American public, they are invisible. Before the work by Edin, Shaefer, and the rest of their team, these 4 million people were invisible even to sociologists. Says Cherlin, "In retrospect, I should have known—we all should have known—that the constriction of the welfare program would create families like this. But we didn't." In $2.00 a Day, Edin says, Here they are. These are their lives. And the question for Americans, she says, is this: "Does this look like the America you want to live in?"

In 1996, when Senator Daniel Patrick Moynihan of New York argued against the welfare reform legislation, he predicted the changes to the country's social safety net would produce a million children sleeping on heating grates. "What we found is that over the course of a year, 3.4 million children are experiencing at least three months of extreme poverty," Edin says. "They aren't as visible as Moynihan thought they would be. But they are three and a half times more numerous."

Posted in Politics+Society

Tagged sociology, kathryn edin